Alfred Rappaport 7 Value Drivers

In this substantially revised and updated edition of his 1986 business classic, Creating Shareholder Value, Alfred Rappaport provides managers and investors with the practical tools needed to generate superior returns. The ultimate test of corporate strategy, the only reliable measure, is whether it creates economic value for shareholders. After a decade of downsizings frequently blamed on shareholder value decision making, this book presents a new and indepth assessment of the rationale for shareholder value. Further, Rappaport presents provocative new insights on shareholder value applications to: (1) business planning, (2) performance evaluation, (3) executive compensation, (4) mergers and acquisitions, (5) interpreting stock market signals, and (6) organizational implementation. Readers will be particularly interested in Rappaport's answers to three management performance evaluation questions: (1) What is the most appropriate measure of performance? (2) What is the most appropriate target level of performance? And (3) How should rewards be linked to performance?

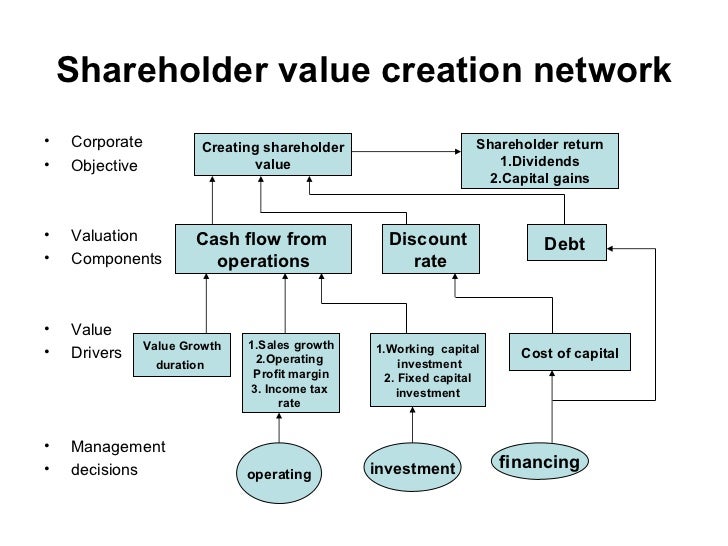

Nov 16, 2007 - According to Alfred Rappaport in Creating Shareholder Value, these factors can be explained by seven key value drivers that must be managed in order to maximize shareholder value: sales growth rate. Operating profit margin. Residual value of future cash flows.

Cc generals zero hour maps pack download pc. The recent acquisition of Duracell International by Gillette is analyzed in detail, enabling the reader to understand the critical information needed when assessing the risks and rewards of a merger from both sides of the negotiating table. The shareholder value approach presented here has been widely embraced by publicly traded as well as privately held companies worldwide.

Brilliant and incisive, this is the one book that should be required reading for managers and investors who want to stay on the cutting edge of success in a highly competitive global economy. Chapter 1 SHAREHOLDER VALUE AND CORPORATE PURPOSE The idea that management's primary responsibility is to increase value has gained widespread acceptance in the United States since the publication of Creating Shareholder Value in 1986. With the globalization of competition and capital markets and a tidal wave of privatizations, shareholder value rapidly is capturing the attention of executives in the United Kingdom, continental Europe, Australia, and even Japan. Over the next ten years shareholder value will more than likely become the global standard for measuring business performance. Crayon shin chan manga raw download. In the early 1980s there were very few companies with an unambiguous commitment to shareholder value. While many companies used piecemeal applications of the shareholder value approach, such as discounted cash-flow analysis for capital budgeting decisions and for merger-and-acquisition pricing, management thinking largely was governed by a short-term earnings orientation. The takeover movement of the latter half of the 1980s provided a powerful incentive for managers to focus on creating value.

Many companies, particularly those in mature industries such as oil, allocated their very substantial excess cash flow toward uneconomic reinvestment or ill-advised diversification. Other companies failed to seek the highest valued use for their assets. For example, retailing establishments, particularly large department stores sitting on valuable downtown real estate, missed the opportunity to sell the real estate and redeploy the cash to value-creating growth or, in the absence of profitable investment opportunities, distribute the cash to shareholders. In each of these cases the stock market predictably penalized the companies' shares. This led to the infamous 'value gap,' i.e., the difference between the value of the company if it were operated to maximize shareholder value and its current market value. A positive 'value gap' was an invitation to well-financed corporate raiders to bid for the company and replace incumbent management. The only compelling takeover defense is to close the 'value gap' by delivering superior shareholder value.